Project partners:

2024 – present

Top photo credit: Tolga Ahmetler / Unsplash

We are a partnership of nine organizations, including community development financial institutions (CDFIs), business assistance organizations, and place-based agencies, funded by the Healthy Food Financing Initiative Partnership Program grant. Our vision is for all communities in the Pacific Northwest to have access to healthy food, which our Partnership will support by providing low interest loans, planning grants, and technical assistance to food businesses and retailers in Alaska, Washington, and Oregon.

Join us for an info-session to learn more about funding opportunities through the Pacific Northwest Resilient Food System Partnership and how eligible businesses can apply.

Washington Info Session | Watch the recording | RSVP for Feb. 10, 2026 at 10A PST info & question session

Oregon Info Session | Watch the recording

Alaska Info Session | Watch the recording

Inside the cold storage facility at Redd West. Photo credit: Shawn Linehan

Kelp harvesting. Photo credit: Emilie Chen

Technical assistance (TA) is available to help organizations and businesses improve access to healthy, affordable food in underserved communities. Through our partners—Prosper Portland, Spruce Root, and the Northwest Agriculture Business Center—we offer a range of support, including 1:1 business counseling, project planning, and financial readiness. Whether you’re launching a new initiative or expanding an existing effort, TA can help you strengthen your approach and address challenges at every stage.

If you are interested in technical assistance or would like to learn more about how it can support your project, please see the partner list below for more information.

Eligible Food Businesses and Retailers can apply for one or both of the grants and loans the Partnership offers. Applications are accepted on a rolling basis. For details on how to apply, see the Apply section below.

These grants are to support business viability and enable access to financing down the road. Grants can be used to pay for costs associated with project planning including but not limited to feasibility studies, legal and financial consulting, business planning, and design and architecture services. 15 to 35 grants are available, depending on the size of awards. Award requests may range from $20,000 to $50,000. Grant funded projects must be completed by June 2027.

This offering is to support business viability and enable accessible and affordable financing. This offering is only available to borrowers seeking financing and supports businesses in meeting CDFI equity requirements or as gap financing. Loans with accompanying grants can be used for a variety of purposes including but not limited to, purchasing inventory or supplies, operational costs including rent, utilities, insurance, payroll or contracted services, marketing and sales, purchasing equipment, and/or refinancing existing debt. 7 to 25 loans with grants are available, depending on financing requests. Interest rate on all loans is 3% and accompanying grants of at least $5,000, increasing with need.

Please note:

Apply

Applications for low interest loans and planning grants are open. Applications will be accepted on a rolling basis and be evaluated in the order received. These funds will be available until early 2027 or all funds are deployed.

The application link below will take you to another website. You will need to create an account, add your business/organization, and submit the eligibility form. If eligible, you will receive an email invitation to complete the planning grant or low interest loan application.

FAQs

Do you have a question that is not answered here? Feel free to get in touch with us at communitycapital@ecotrust.org.

We can fund HFFI eligible food retailers and businesses serving communities in Alaska, Washington, and/or Oregon. The Partnership’s goal is to increase access to resources and support to underserved communities. We prioritize financing for food retailers and businesses that are marginalized due to their race, ethnicity, and/or gender, as well as rural communities, in Alaska, Oregon, and Washington.

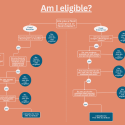

Project eligibility is based on your business type (food retailer or business) and how your project increases access to healthy foods in low access communities. You can use this flow chart to assess your project’s eligibility or the short list below.

*Please use this map to view eligible areas; note that if you are located in Alaska and not eligible on the linked map, please still reach out to us.

Project eligibility is based on the Health Food Financing Initiative requirements, as this funding is provided through the Reinvestment Fund’s Partnership Program grant.

To increase access to culturally relevant and healthy foods, we will prioritize food retailers that sell both staple (grains, dairy) and perishable goods (vegetables, fruits, proteins). To learn more about staple and perishable goods please see SNAP staple foods site. For food businesses, we will prioritize projects that sell to retailers that carry both staple and perishable goods.

We have two types of financing available; Planning Grants and Low Interest Loans with Grants. Please see the “Grants and Financing Available” section above for more information.

Each application is made up of two parts. You will first have to create an account on our portal and submit an eligibility application. If your project is eligible, you will be invited to complete a low-interest loan or planning grant application (depending on which you selected to apply for in your eligibility application). Additionally, through our portal, you are able to invite others from your projects to support in filling out your application.

Each application is reviewed by a state-based committee who utilizes a shared set of criteria and consensus based decision making model. From eligibility to closing a loan, the process can take a month up to several months to complete.

We’ve put together this Loan Application Process and Checklist to help answer this question.

Our goal is to increase access to resources and support to underserved communities. We prioritize financing for food retailers and businesses that are marginalized due to their race, ethnicity, and/or gender in Alaska, Oregon, and Washington.

Yes, both of our financial offerings include grants. Please see the “Grants and Financing Available” section above for more information.

Partners

Our CDFI partner in Washington, offering loans through this Partnership. Point of contact: Toni Stinnett

Our CDFI partner in Oregon, offering loans through this Partnership. Point of contact: Nicci Walker

Our Native CDFI partner in Southeast Alaska, offering loans and technical assistance through this Partnership. Point of contact: Abbey Janes

Our Technical Assistance partner in Washington, offering technical assistance through this Partnership. Point of contact: Maxime Etilé

Our project is a recipient of the Partnership Program grant. America’s Healthy Food Financing Initiative (HFFI) aims to build a more equitable food system that supports the health and economic vibrancy of all Americans.

Our Public Entity partner in Portland, connecting Portland applicants to one on one technical assistance through this Partnership. Point of contact: Yvonne Smoker

Washington community and outreach partner; also serving on the decision making committee. Point of contact: Mary Embleton

Washington community and outreach partner; also serving on the decision making committee. Point of contact: Michael Lufkin

Washington community and outreach partner; also serving on the decision making committee. Point of contact: Elizabeth Kimball

Photo credit: Roland Dahwen

Ecotrust Project Team & Services

Want to learn more? Check out the full Ecotrust Staff & Board and all of our Tools for Building Collective Change.

Cultivate leaders and assist with funding sources.

Build and deliver mission-aligned projects in partnership.

Contribute tools, analyses, and frameworks that move projects forward.

Resources

Video

From Grow America, a non-profit that invests capital to craft

equitable, vibrant futures.

Video

From Grow America, a non-profit that invests capital to craft

equitable, vibrant futures.

Video

From Grow America, a non-profit that invests capital to craft

equitable, vibrant futures.

FLOWCHART

This resource includes definitions for a food retailer and business, plus a hand flowchart to determine eligibility.

CHECKLIST

This resource includes an overview of the loan application process and checklist of necessary documents to complete.